Exness Web Terminal

Web-Based Trading Platform Architecture

The Exness Web Terminal operates through an advanced HTML5 framework, enabling direct market access without software installation requirements. Our platform processes trades through 70+ dedicated servers worldwide, ensuring execution speeds below 0.3 milliseconds. The terminal integrates TradingView charting technology, providing real-time market data and technical analysis tools. The system architecture supports simultaneous connection of 100,000+ users while maintaining stable performance. Connection redundancy protocols automatically switch between servers to prevent trading interruptions.

Platform Specifications:

Feature | Details |

Execution Speed | 0.1-0.3 ms |

Chart Updates | 1000/second |

Available Instruments | 200+ |

Order Types | 6 types |

Technical Indicators | 50+ |

Interface Components and Functionality

The terminal interface divides into customizable modules for efficient trading operations. The main window contains real-time quotes, charts, trading panels, and position management tools. Users configure workspace layouts through drag-and-drop functionality, saving multiple arrangements for different trading strategies. The system monitors CPU and RAM usage, automatically optimizing performance based on available resources.

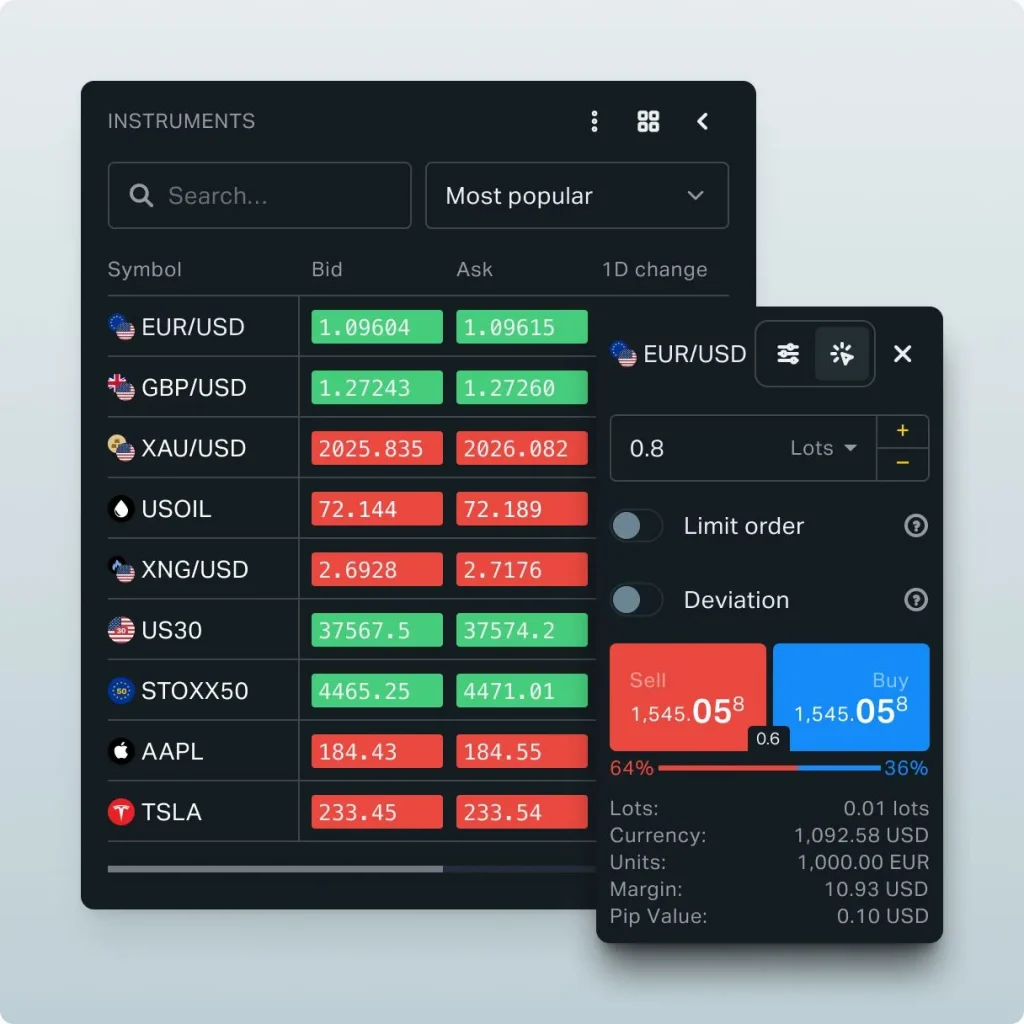

Watchlist Configuration

The watchlist module displays real-time price movements for selected instruments. Users create multiple watchlists, each supporting up to 50 instruments with customizable columns showing spread, daily change, and trading volume. The system updates prices every 0.1 seconds through dedicated price feeds.

Trading Execution System

The order execution mechanism processes market orders through smart routing technology, connecting to multiple liquidity providers. Order types include market, limit, stop, stop-limit orders with customizable parameters. The platform supports one-click trading mode with pre-set volume and risk parameters.

Order Processing Capabilities:

- Direct Market Access (DMA) execution

- Smart order routing across liquidity pools

- Advanced order types with OCO functionality

- Position sizing calculator integration

- Real-time margin calculation

- Automated risk management tools

- Multi-level position management

Chart Analysis Tools

TradingView integration provides professional-grade charting capabilities with 50+ technical indicators. Chart types include candlestick, bar, line, and Renko charts across 12 timeframes from M1 to MN. Drawing tools support trend lines, Fibonacci retracements, and Elliott Wave analysis.

Technical Analysis Features

The platform includes built-in technical analysis tools calculating support/resistance levels, pivot points, and volatility bands. Users apply multiple indicators simultaneously, with automated pattern recognition for common chart formations.

Risk Management Functions

The terminal incorporates automated risk calculation tools monitoring margin levels and position exposure. Stop-loss and take-profit levels can be set directly on charts with visual confirmation. The system calculates position sizing based on account equity and risk parameters.

Risk Monitoring Metrics:

Parameter | Range |

Margin Call | 40-100% |

Stop Out | 0-50% |

Max Positions | 500 |

Order Volume | 0.01-500 lots |

Stop Out Protection System

The proprietary protection mechanism monitors margin levels continuously, implementing gradual position reduction rather than immediate liquidation. The system calculates optimal lot reduction based on market volatility and account equity.

Portfolio Management Tools

The portfolio area displays active positions, pending orders, and account statistics in real-time. Position modification tools allow direct chart-based adjustment of stop-loss and take-profit levels. The system calculates key metrics including profit/loss, swap rates, and margin requirements.

Trade History Analysis

The history module stores detailed transaction records with customizable reporting options. Users analyze trading performance through built-in statistical tools calculating win rates, average trade duration, and profit factors.

Market Data Integration

Real-time market data feeds through multiple providers ensure accurate price quotes and depth of market information. Economic calendar integration displays upcoming market events with expected impact levels. News feeds provide market analysis and trading signals directly within the platform.

Platform Customization Options

Users customize interface layouts, chart settings, and trading parameters according to individual preferences. The system saves multiple workspace configurations for different trading strategies. Color schemes adjust automatically between day and night modes based on system time.

Account Management Features

| Metric | Update Frequency |

| Balance | Real-time |

| Equity | Real-time |

| Margin Level | Every 0.1s |

| Open P/L | Every 0.1s |

FAQ:

The terminal requires a modern web browser (Chrome 80+, Firefox 75+, Safari 13+) with stable internet connection minimum 1 Mbps. The platform operates optimally with 4GB RAM and dual-core processor.

One-click trading enables instant order execution through pre-configured volume and risk parameters. Users activate this mode through settings panel, selecting default order size and maximum position limits.

The platform implements automatic reconnection protocols, maintaining open positions during brief disconnections. Upon reconnection, all position data synchronizes automatically with server status.