Exness: Registration Process in India

Introduction to Exness Registration

Exness offers a streamlined registration process for Indian traders seeking to access global financial markets. The registration procedure is designed to be user-friendly, secure, and compliant with local regulations. Exness provides multiple account types to cater to different trading styles and experience levels. The registration process involves several key steps, including personal information submission, account type selection, and identity verification.

Registration Methods

| Method | Description | Estimated Time |

| Website Sign-up | Complete registration form on Exness website | 5-10 minutes |

| Mobile App | Register through Exness mobile application | 5-10 minutes |

| Partner Referral | Sign up via Exness partner links | 5-10 minutes |

| Social Media Login | Register using existing social media accounts | 3-5 minutes |

| Phone Registration | Complete registration process over the phone | 10-15 minutes |

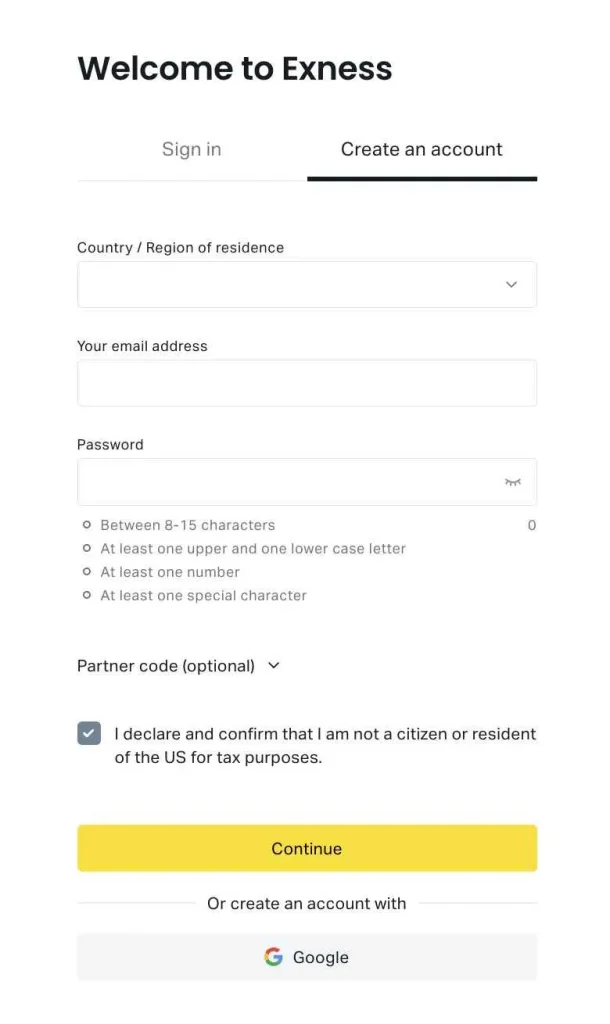

Step-by-Step Registration Process

The Exness registration process for Indian traders consists of several straightforward steps. First, visit the official Exness website or download the mobile app. Click on the “Open Account” or “Register” button to begin. Enter your email address and create a secure password for your account. Provide your personal information, including full name, date of birth, and contact details. Select your preferred account type from the available options.

Required Information for Registration

• Valid email address

• Full legal name as per official documents

• Date of birth

• Phone number

• Residential address in India

• Preferred account currency (e.g., INR, USD)

Account Types Available for Indian Traders

Exness offers various account types tailored to meet the diverse needs of Indian traders. The Standard Account is suitable for beginners, offering commission-free trading and low minimum deposits. Professional Accounts cater to experienced traders, providing tighter spreads and advanced trading conditions. Raw Spread Accounts offer institutional-grade pricing with ultra-low spreads and fixed commissions.

Identity Verification Process

After completing the initial registration, Indian traders must undergo an identity verification process to comply with regulatory requirements and ensure account security. Exness employs a tiered verification system, allowing traders to access certain features immediately while completing full verification. The basic verification involves submitting a copy of a government-issued ID, such as an Aadhaar card or passport.Accepted Verification Documents

• Aadhaar Card • Passport • Driver’s License • PAN Card • Voter ID CardFunding Your Exness Account

Once the registration and verification processes are complete, Indian traders can fund their Exness accounts to start trading. Exness offers multiple funding methods tailored for the Indian market. These include local bank transfers, UPI payments, popular e-wallets, and cryptocurrency deposits. The minimum deposit amount varies depending on the chosen account type and funding method.| Funding Method | Processing Time | Minimum Deposit |

| Local Bank Transfer | 1-3 business days | ₹1000 |

| UPI | Instant | ₹500 |

| E-wallets (Skrill) | Instant | ₹1000 |

| Cryptocurrency | 10-30 minutes | Equivalent ₹500 |

| Credit/Debit Cards | Instant | ₹1000 |

Setting Up Trading Platforms

After successful registration and account funding, Indian traders can set up their preferred trading platforms. Exness supports popular platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Traders can download these platforms directly from the Exness website or use the web-based trading terminal. Mobile versions of MT4 and MT5 are available for iOS and Android devices, allowing traders to manage their accounts on the go.

Account Security Measures

Exness prioritizes the security of Indian traders’ accounts through various measures implemented during and after the registration process. Two-factor authentication (2FA) is available to add an extra layer of security to account logins. Exness uses advanced encryption technologies to protect personal and financial information. Regular security audits and updates ensure that the trading environment remains secure against emerging threats.

Customer Support During Registration

| Support Channel | Availability | Response Time |

| Live Chat | 24/7 | Instant |

| Email Support | 24/7 | Within 24 hours |

| Phone Support | Business hours (IST) | Instant |

| FAQs & Knowledge Base | 24/7 | Self-service |

| Social Media | Business hours (IST) | Within 4 hours |

FAQ:

The initial registration can be completed in 5-10 minutes. However, the full verification process may take 1-3 business days, depending on the submitted documents and verification queue.

Yes, Exness allows Indian traders to open multiple account types under a single registration. You can manage different account types from your personal area after completing the registration process.

While you can complete the registration process without a deposit, most account types have a minimum deposit requirement to start trading. The minimum deposit can be as low as ₹500, depending on the chosen account type and funding method