Exness Demo Account

Demo Account Structure and Functionality

| Type | Initial Balance | Leverage | Platforms |

| Standard | $10,000 | Up to 1:2000 | MT4/MT5 |

| Pro | $50,000 | Up to 1:200 | MT4/MT5 |

| Zero | $100,000 | Up to 1:100 | MT5 only |

| Raw Spread | $100,000 | Up to 1:100 | MT5 only |

Trading Conditions Simulation

Demo accounts replicate exact market conditions including spreads, swaps, and execution types. Order processing occurs through the same infrastructure as real accounts with identical execution speeds. The system calculates margin requirements and leverage restrictions according to actual market rules. Price feeds come directly from live market data ensuring authentic trading conditions. Virtual positions undergo the same swap calculations and rollover procedures as real accounts.

Spread and Commission Structure

Demo accounts maintain identical spread structures to real accounts based on account type selection. Pro and Zero accounts include virtual commission calculations matching real account specifications. Raw spread accounts demonstrate actual markup structures and execution fees.

Trading Parameters:

- Real-time market spreads

- Actual swap calculations

- Commission structures

- Leverage restrictions

- Margin requirements

- Stop out levels

- Order execution rules

Platform Functionality Access

Demo accounts provide full access to all trading platform features and analytical tools. Users utilize complete charting capabilities including technical indicators and drawing tools. Expert Advisor testing capabilities enable automated strategy verification without restrictions. The system supports multiple timeframe analysis and custom indicator implementation.

Technical Analysis Tools

All technical analysis features remain available including built-in and custom indicators. Chart types and timeframes match real account capabilities with full customization options. Drawing tools enable comprehensive technical analysis implementation during strategy development.

Order Execution System

The demo environment processes orders through identical execution pathways as real accounts. Market and pending order types function according to actual market rules and conditions. Stop loss and take profit levels apply with the same precision as real trading accounts.

Order Processing Specifications:

Feature | Value |

Execution Speed | 0.1-0.3 ms |

Order Types | 6 |

Min Volume | 0.01 lots |

Max Volume | 500 lots |

Pending Orders | Unlimited |

Modification Speed | Real-time |

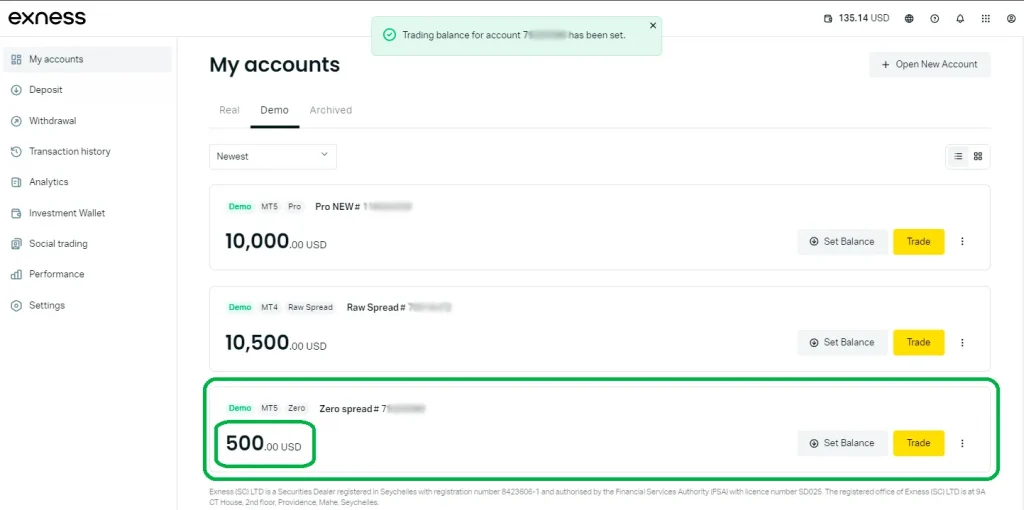

Account Management Features

Demo accounts include complete account management functionality through Personal Area integration. Users monitor account metrics including balance, equity, and margin levels in real-time. The system provides detailed trading history and performance analytics. Position management tools enable modification of open orders and pending positions.

Performance Analytics

The platform generates comprehensive trading statistics including profit/loss calculations, win rates, and risk metrics. Performance reports detail trading activity across multiple timeframes with exportable data formats. Analysis tools help identify strategy effectiveness and areas for improvement.

Market Data Integration

Demo accounts receive real-time market data feeds ensuring authentic price discovery. Economic calendar events impact virtual positions identical to real market conditions. News feed integration provides market analysis and trading signals directly within platforms.

Price Feed Implementation

The system delivers real-time price updates through the same data feeds as real accounts. Market depth information displays actual liquidity conditions and order book status. Tick data accuracy matches live trading environment specifications.

Strategy Testing Capabilities

Demo accounts support comprehensive strategy testing through manual and automated trading methods. Expert Advisor implementation enables automated strategy verification in live market conditions. The system maintains detailed performance metrics for strategy evaluation and optimization.

Strategy Testing Features:

- Live market condition testing

- Expert Advisor verification

- Custom indicator evaluation

- Risk management validation

- Position sizing analysis

- Entry/exit timing optimization

- Performance documentation

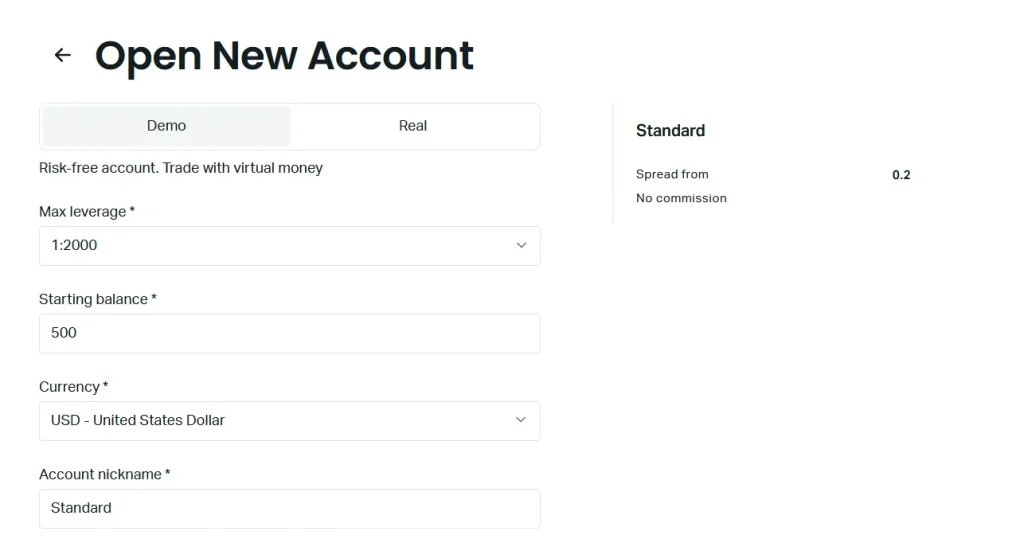

Account Duration and Reset Options

Demo accounts operate without time restrictions maintaining continuous market access. Users reset virtual balances through Personal Area controls when needed. Account settings and configurations persist through balance resets maintaining strategy testing continuity.

Trading Duration Parameters:

Feature | Specification |

Duration | Unlimited |

Reset Frequency | Unlimited |

Balance Options | $10k-$100k |

Settings Retention | Yes |

History Storage | 90 days |

Platform Access | 24/7 |

Educational Integration

Demo accounts integrate with educational resources providing practical application opportunities. Trading scenarios demonstrate various market conditions and strategy implementations. The system supports multiple learning paths through progressive complexity levels.

FAQ:

Demo accounts utilize identical execution infrastructure as real accounts, maintaining same execution speeds, spreads, and market conditions. The only difference involves virtual fund allocation instead of real capital.

Yes, users create multiple demo accounts across different platforms and account types. Each account maintains separate settings and trading history while sharing same market access.

Demo accounts remain active for 21 days without trading activity. After this period, accounts archive with option to create new demo accounts maintaining previous settings and configurations.